Quick market figures

The Total Addressable Market (TAM) for public DeFi has experienced robust growth from 2021 to 2023, with billions of dollars in value locked across various protocols. Our Serviceable Available Market (SAM) within this sphere is focused on users and entities prioritizing transaction convenience, privacy and security, which we estimate to be a substantial subset of the overall DeFi space. The Serviceable Obtainable Market (SOM) for our platform is projected to expand significantly, as Real World Assets (RWA) begin to integrate with DeFi, thereby enhancing the quality and diversity of on-chain assets. Moreover, the anticipated entry of regulated stablecoins, spurred by legislative frameworks like MiCA, is expected to infuse DeFi with considerable liquidity and stimulate demand for crypto assets. These developments align with our strategic positioning to capture the growing need for cross-chain and private transactions as well as newbies entrance.

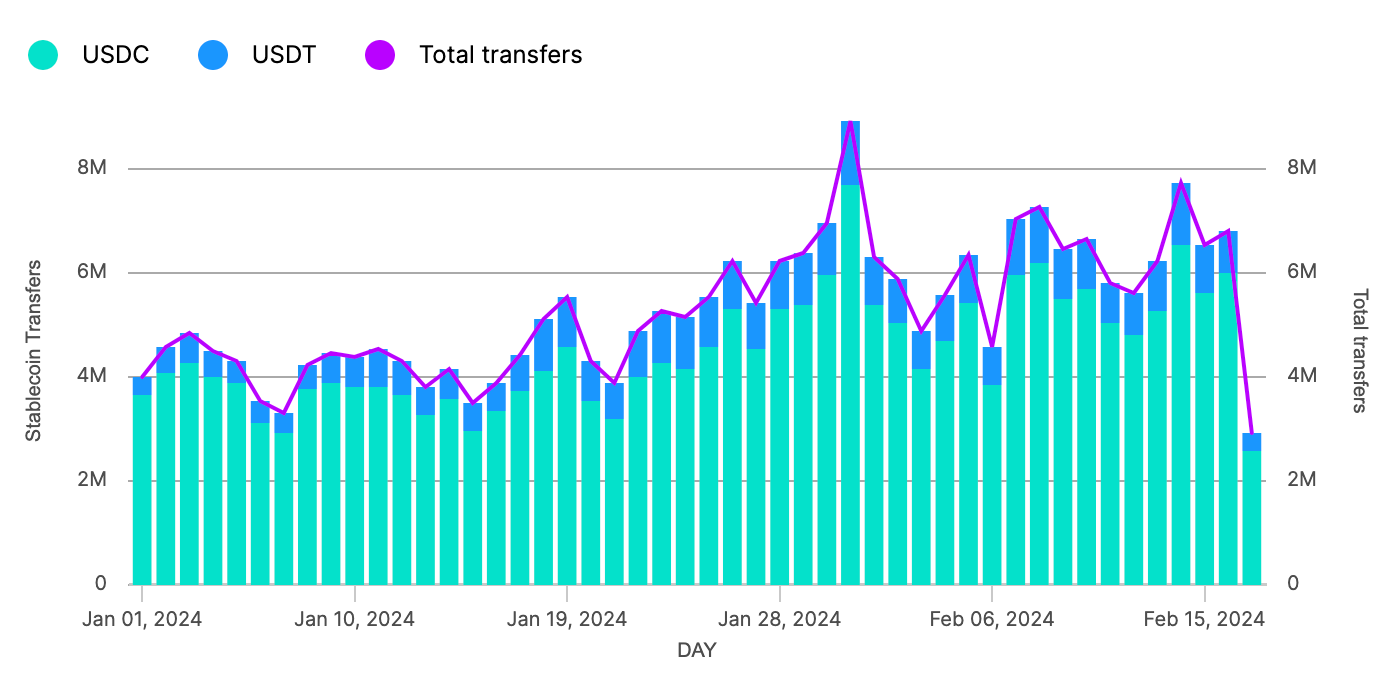

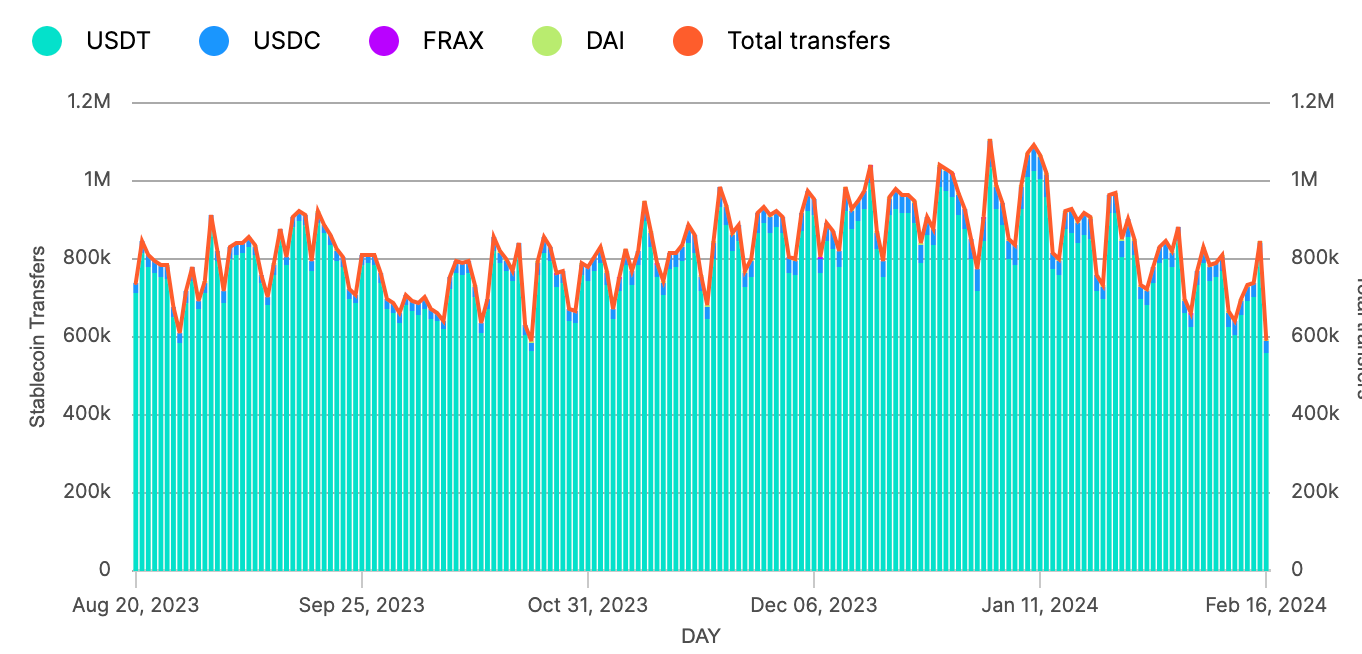

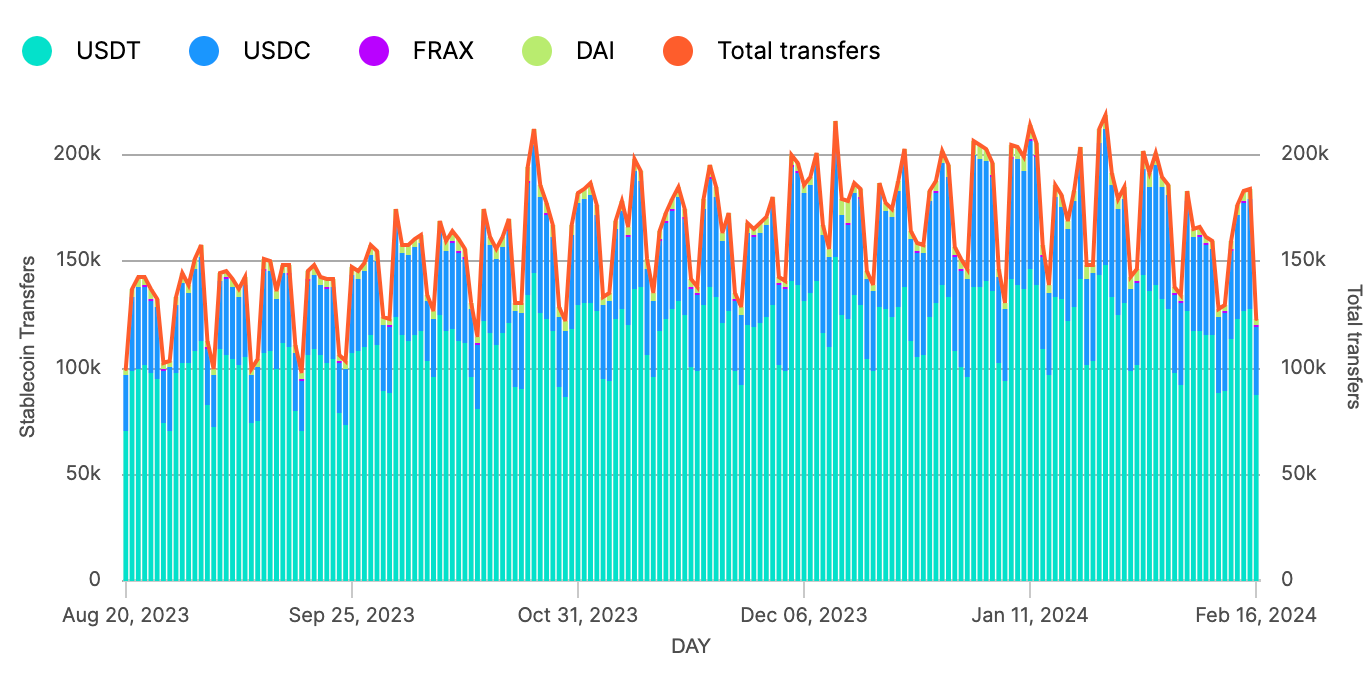

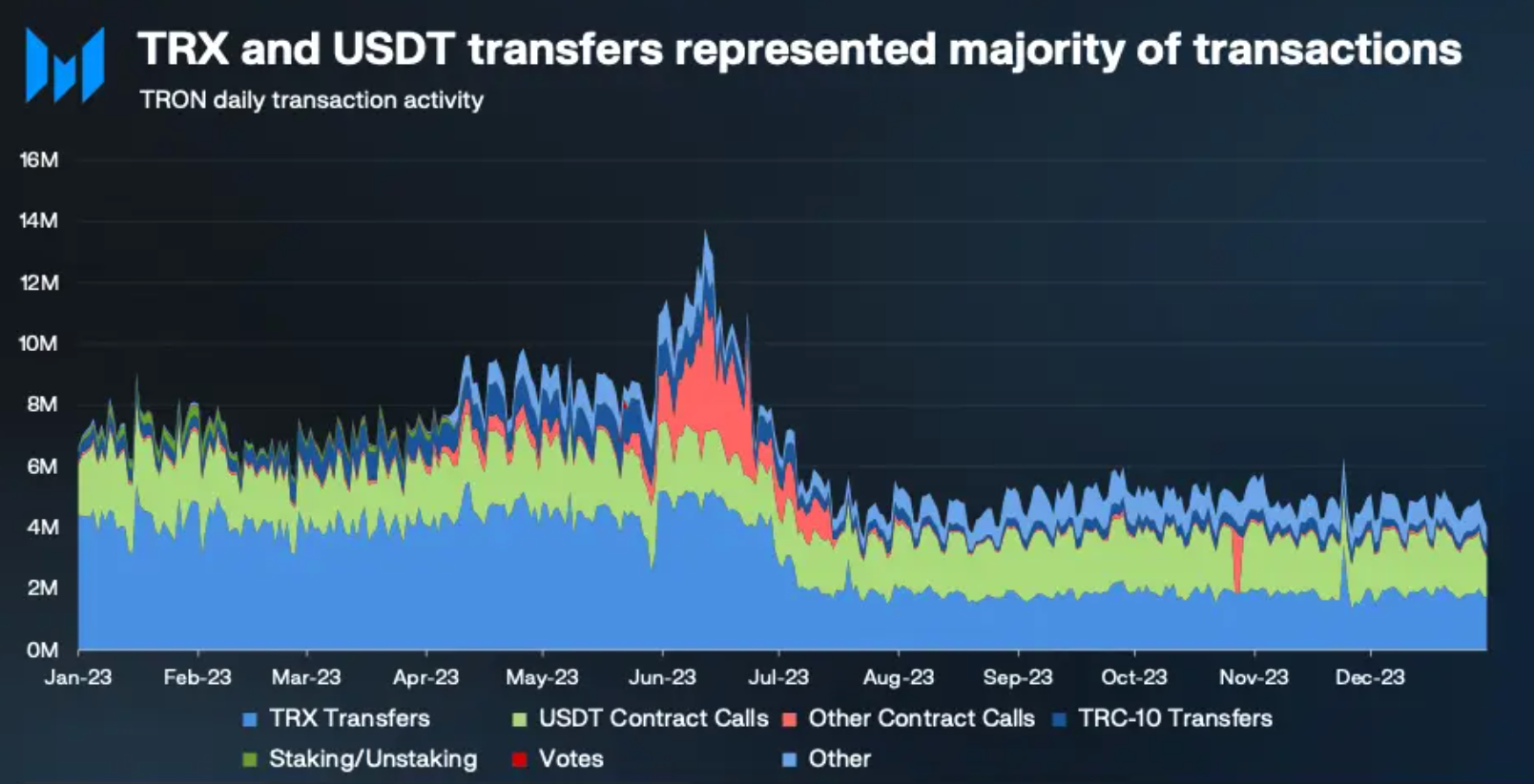

Aligning with our strategy of 4 focused blockchains at the first stage (Tron, ETH, BNB, Solana) we have considered daily transactions for stable coins and stable coins transactions over $3k. Not limiting ourselves by only stable coins or large transactions by volume, we believe that such segments will be the most relevant for our solution.

Stable coins daily transactions:

Taking into account the transactions over $3k and assuming the average service markup in $0.1, we could define monthly TAM total and TAM OTC:

Solana

180,000,000

30,000,000

Tron

45,000,000

9,000,000

Eth

3,600,000

750,000

BNB

24,000,000

240,000

TAM, a month

$25,260,000

TAM OTC, a month

$3,999,000

Last updated